Last week, I spent four great (and exhausting) days at the ICSC RECon event in Las Vegas. This is THE event for retailers, real estate developers, vendors, and economic developers. I enjoyed meeting with current and prospective clients from EDOs across the US, and would like to share some takeaways from my interactions with them and from the show in general:

“Land based” Retail may not be dying a natural death. On Day One of the conference I watched the VIVA (Vision, Innovation, Value & Achievement) Awards. A grand total of THREE awards went to U.S. based malls/property developers/architects. Reviewing all the VIVA award winners, it struck me that there is enormous opportunity to innovate with old fashioned malls in particular, and the brick and mortar shopping experience in general. I’d love to see more innovation and more VIVA award winners from the US. Economic development professionals can help with this by conducting an inventory of existing properties with an eye towards redevelopment.

“Land based” Retail may not be dying a natural death. On Day One of the conference I watched the VIVA (Vision, Innovation, Value & Achievement) Awards. A grand total of THREE awards went to U.S. based malls/property developers/architects. Reviewing all the VIVA award winners, it struck me that there is enormous opportunity to innovate with old fashioned malls in particular, and the brick and mortar shopping experience in general. I’d love to see more innovation and more VIVA award winners from the US. Economic development professionals can help with this by conducting an inventory of existing properties with an eye towards redevelopment.

ZoomProspector Enterprise can help a redevelopment effort by allowing EDOs to easily and quickly pull up demographics and consumer spending reports to justify new investments. As an example, an “old” shopping mall might lay in a suburb with a growing population of millennials with high income who are or will soon start families. You see this especially in the exurbs around major cities like LA and San Francisco, Dallas etc. Showing innovative developers current demographics and 5 year projections (as with this report on a retail development in Los Angeles County) can help make the case for taking a leap of faith, small or large, with a new development project.

Is supply chain logistics the new retail? This was a question I had going into ReCon. With Amazon and other e-commerce rapidly grabbing the total share of retail spending, are economic developers better served focusing on the logistics and supply chain vs. traditional retailers?

I posed this question to several of the economic development professionals I met in Las Vegas. Some of my respondents confirmed this trend, others pointed to the basic fact that most EDOs, to say nothing of cities, get substantial tax revenue from retail sales tax. Tax revenue derived from logistics can’t make up for the loss of sales tax from brick and mortar retailers.

One could see cities being tempted to raise retail sales taxes just as e-commerce ramps up, as a means to fill in the revenue gap caused by increased e-commerce, leading to a potential “death spiral” for retailers, especially small, independently owned “mom and pop” stores.

The media is focused on the “death of retail” but are ignoring the fact that retail, like any other industry, is cyclical. For every old school retailer that’s going under, there are a dozen small to mid-sized retailers you have not heard of. Yet.

At ReCon I met companies like BTW and Woodspring Hotels that are growing on a rapidly on a regional and national basis. We’re seeing a major shift in how consumers in the US spend their time and economic developers can help their communities navigate these changes. RECon and the ICSC Regional events are great places to meet exciting new businesses, trade ideas about how to attract people to their retail centers, and redefine what a retail center is.

GIS Planning offers a suite of online data tools to showcase existing and future demographics and spending patterns of consumers and tie those data points to actual sites and buildings, or to look at communities or custom defined parts of communities. Check out some of our clients here.

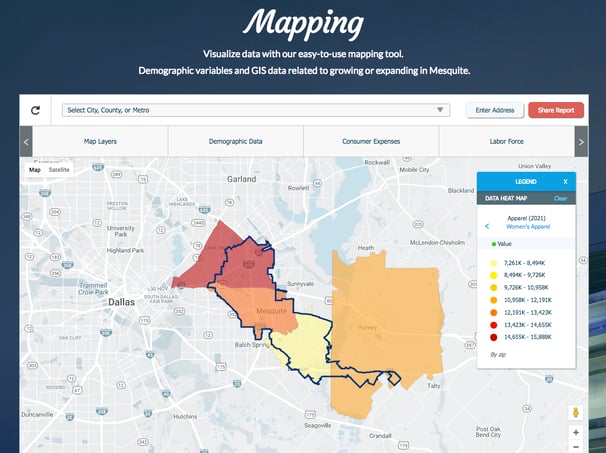

It’s easy to research, analyze, map and share retail clusters using the Business Data Intelligence Component, as with these examples of grocery stores or women’s clothing retailers in the City of Mesquite, TX.

Tracking consumer expenditures is also a key part of researching retail locations. You can see how the City of Mesquite's Mapping Intelligence Component is easily used to track and map these, as with this report on spending for women’s apparel.

Moreover, it’s simple to compare data points in different communities across the U.S. using the Compare Communities Intelligence Component. Here you can see how the City of Mesquite compares with the City of Vallejo, CA for household income distribution. Compare up to 11 communities by city or county, and share reports with the click of a mouse.

Want to know more about how the six Intelligence Components (including our newly launched Talent Pool data tool), and our GIS location analysis tool, ZoomProspector Enterprise, can work for your location? Get in touch and we can walk you through a customized demo based on your community's needs.